The insurance industry faces significant challenges in managing claims efficiently:

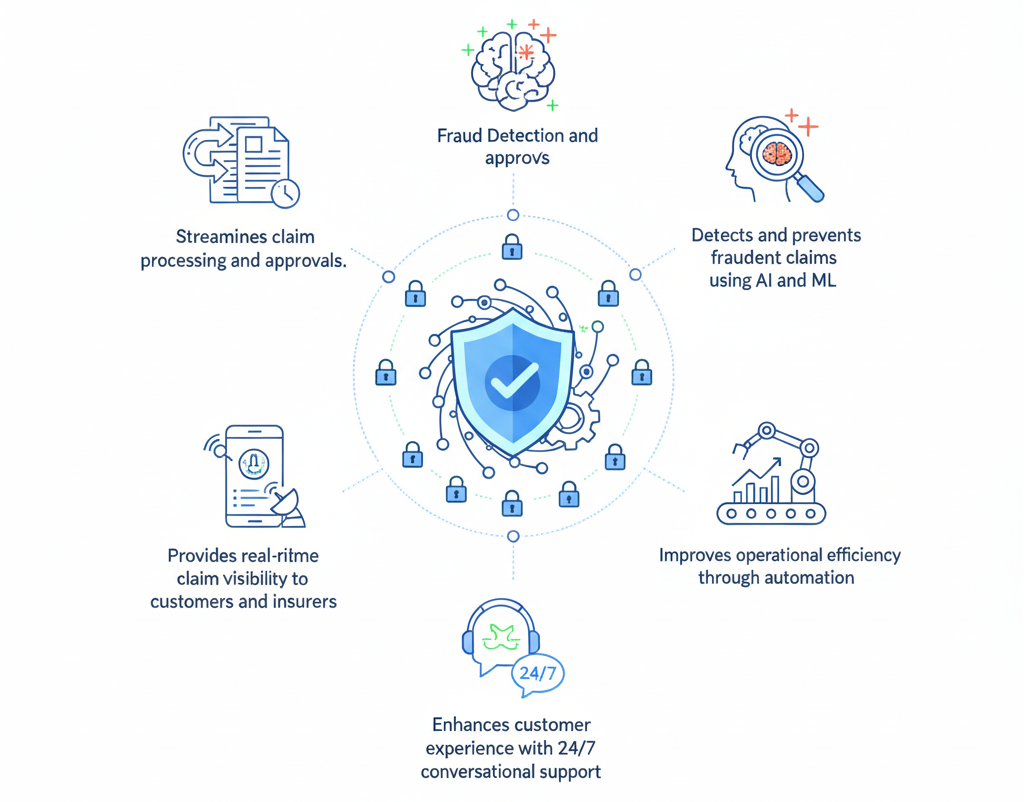

Manual claim handling is slow, inconsistent, and costly.

High volume of repetitive queries such as claim status or tracking.

Rising number of fraudulent claims impacting profitability.

Growing demand for 24/7 proactive customer support.

Claim Buddy was created to address these issues — empowering insurers with automation, real-time insights, and intelligent fraud detection.

Claim Buddy is the AI-driven fraud detection platform. It uses predictive analytics and machine learning to detect anomalies in claim behavior — identifying risks before they turn into losses.

By analyzing claim history, transaction patterns, and behavioral signals, Fraud Protect:

Detects suspicious or duplicate claims

Flags inconsistencies for further verification

Continuously learns and improves accuracy with each new dataset

Organizations using Claim Buddy experience measurable improvements:

through automation

using ML scoring

reducing dependency on manual response teams

with real-time insights and analytics

ensuring customer confidence and brand credibility

Claim Buddy is built on Salesforce’s enterprise-grade security foundation, ensuring data protection and compliance across all touchpoints:

Restricts data visibility to authorized users.

Protects sensitive data both at rest and in transit.

Ensure full traceability for compliance and governance.

Governed ML models for explainable, bias-free predictions.

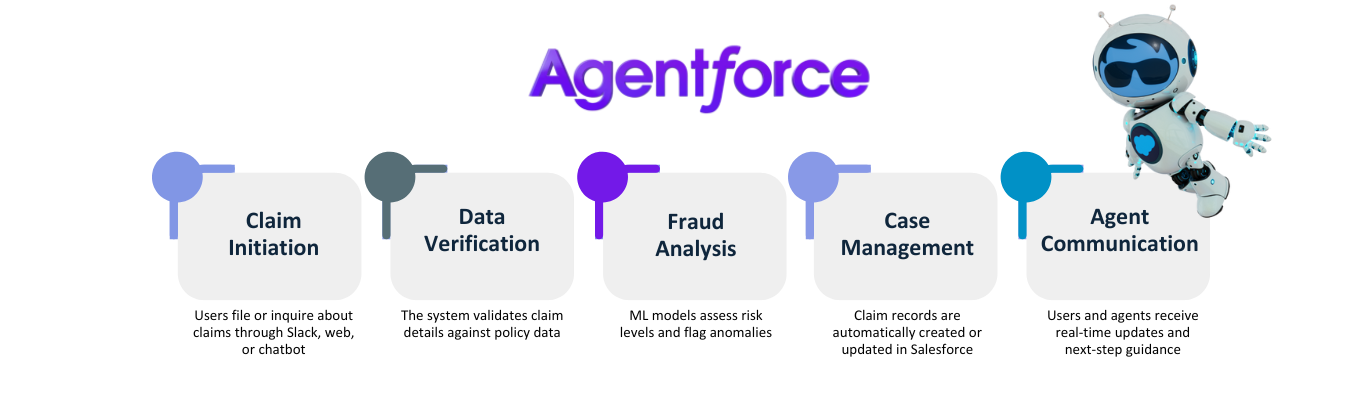

Built entirely on Agentforce, Claim Buddy’s flow streamlines the complete claim lifecycle:

This flow ensures a seamless, automated, and transparent claim experience — without manual intervention.